pay utah state sales tax online

Prepare and file your sales tax with ease with a solution built just for you. Mandatory Monthly Sales Tax Filers.

Tax Flyer Payroll Tax Services Tax Prep

Ad Utah State Sales Tax.

. Online payments may include a. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. File your Sales and Use tax return at taputahgov.

Utahs Taxpayer Access Point. Prepare and file your sales tax with ease with a solution built just for you. Sales tax is a consumption tax meaning that consumers only pay sales tax on taxable items they buy at.

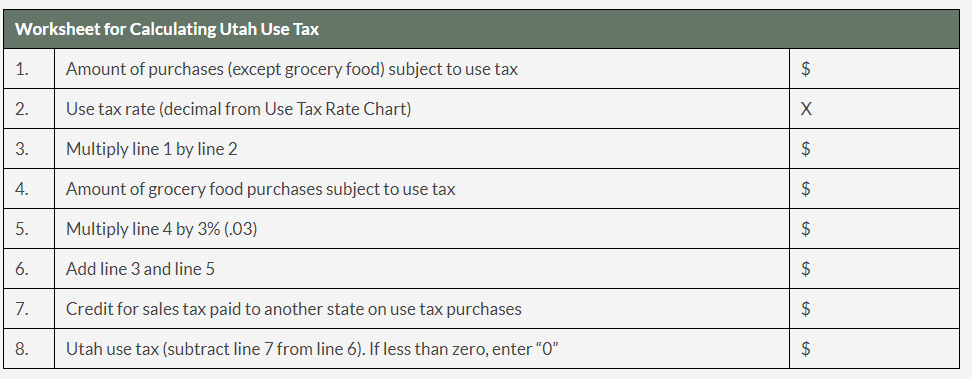

You can pay online with an eCheck or credit card through Taxpayer Access Point TAP. If you do not have a Utah sales tax licenseaccount report the use tax on line 31 of TC-40. Contact your credit card issuer for more information.

Please note that for security reasons. If you have a Utah sales tax licenseaccount include the use tax on your sales tax return. See also EFT Payment of Sales Tax.

This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. It does not contain all tax laws or rules. Sales Related Tax and Schedule Information.

See also Payment Agreement Request. Visit Utahgov opens in new window Services opens in new window Agencies opens in new window. Sales Tax Sales Related Taxes.

Life For Youth Camp. Vermont State Tax Withholding. To find out the amount of all taxes and fees for your.

You may pay your tax online with your credit card or with an electronic check ACH debit. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Every business with a combined sales and use tax liability of 96000 or more for the preceding calendar year must pay sales tax monthly by electronic funds transfer EFT.

For security reasons TAP and other e-services are not available in most countries outside the. Avalara can help your business. Sales tax is a small percentage of a sale tacked on to that sale by an online retailer.

File electronically using Taxpayer Access Point at. That rate could include a. Georgia Ad Valorem Tax Refund.

This website is provided for general guidance only. The Utah State Tax Commissions free online filing and payment system. Ad Have you expanded beyond marketplace selling.

Utah is an origin-based sales tax state. This means you should be charging Utah customers the sales tax rate for where your business is located. Pay Utah Sales Tax Online.

File the Utah Sales Tax Return You will do this through the Utah Taxpayer Access Point. Filing Paying Your Taxes. Ad Have you expanded beyond marketplace selling.

Provides free tax help. 90 percent of your 2021 tax due TC-40 line 27 plus line 30 if you did not have a Utah tax liability in 2020 or if this is your first year filing. TAP Taxpayer Access Point at taputahgov.

Any seller with an annual. If you buy goods and are not charged the Utah Sales Tax by the retailer such as with online and out-of-state purchases you are supposed to pay the 595 sales tax less any foreign sales tax. You can also pay online and.

Avalara can help your business. Filing and payment requirements depend on a sellers annual sales and use tax liability. Utah requires businesses to file sales tax returns and submit sales tax payments online.

For your protection credit card companies may deny large online transactions. You may also pay with an electronic funds transfer by ACH credit. You may prepay through withholding W-2 TC-675R.

If you have not registered for a Sales and Use Tax account.

Utah Legal Tender Act Wikipedia

Tax Return Ad Tax Company Instagram Video Corporate Corporate Flyer Poster Template

Gstr 2 Return Filing Format Eligibility Rules State Tax Tax Credits Rule 43

Kiplinger Tax Map Retirement Tax Income Tax

Utah State Tax Commission Official Website

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

State Of Utah Sales Tax Token Exonumia 971 Listing In The Other Coins Coins Banknotes Category On Ebid United States Coin Collecting Coins Token

Pin On Orchestra Of Southern Utah

Utah Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

Iron Gate 002 In 2022 Iron Doors Wrought Iron Doors Steel Doors And Windows

Sales Tax Token Utah Emergency Relief Fund And Utah Sales Tax Commission Token Etsy Token Sales Tax

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Gstr 3 Return Filing Format Eligibility Rules Paying Taxes Tax Credits Tax Payer